UI/ UX Case Study for Cash Loop

A Unified Banking System

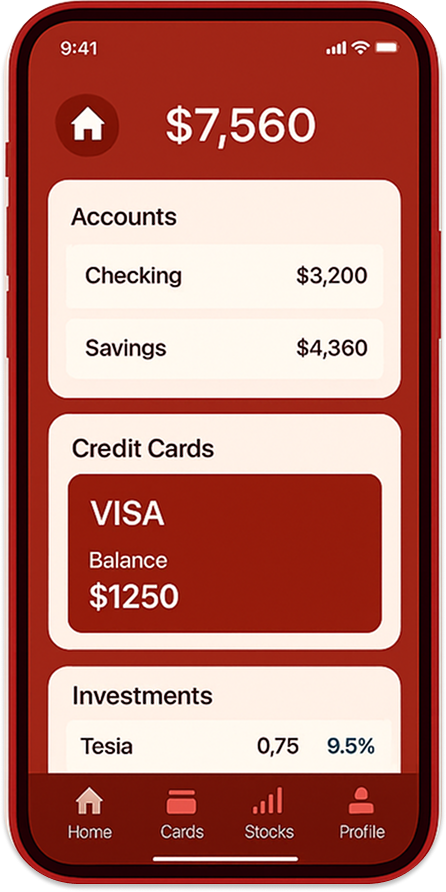

Cash loop a all-in-one financial app that brings banking, credit cards, and investments together into a single seamless experience. The app helps users track their spending, monitor their stock portfolio, and understand their overall financial health without switching between multiple platforms.

"Redefining banking for the modern world your money, your control, anytime, anywhere!"

To redesign a banking mobile application that simplifies financial management, improves accessibility, and enhances user trust through an intuitive and modern interface.

PROBLEM STATEMENT

People currently manage their finances using multiple apps — one for banking, one for stocks, another for credit cards, and sometimes spreadsheets to track totals. This fragmentation leads to:

Lack of visibility into real financial status

Difficulty tracking investments and daily spending together

Time wasted switching between apps

Inconsistent UI patterns across platforms

No unified budgeting or net-worth tracking

How might we create a single app where users can easily monitor, manage, and invest their money in one place?

GOAL

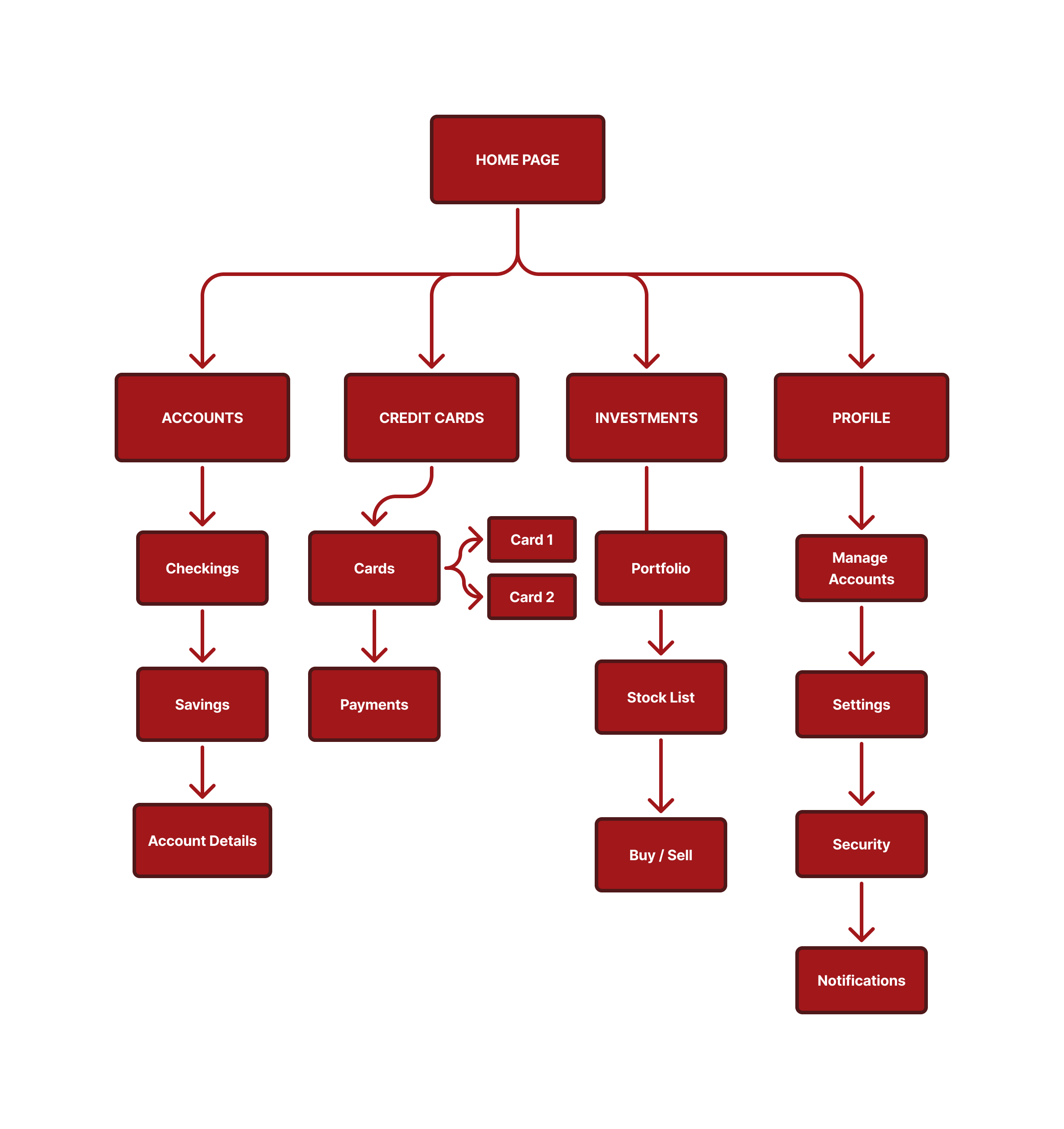

Provide a unified financial dashboard

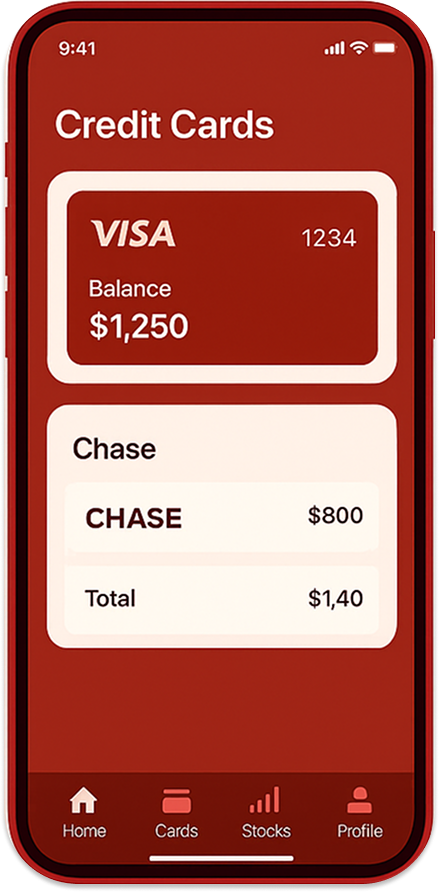

Help users view bank accounts + stocks + credit cards at a glance

Support quick transactions, stock trading, and budgeting

Deliver secure, simple, and intuitive navigation

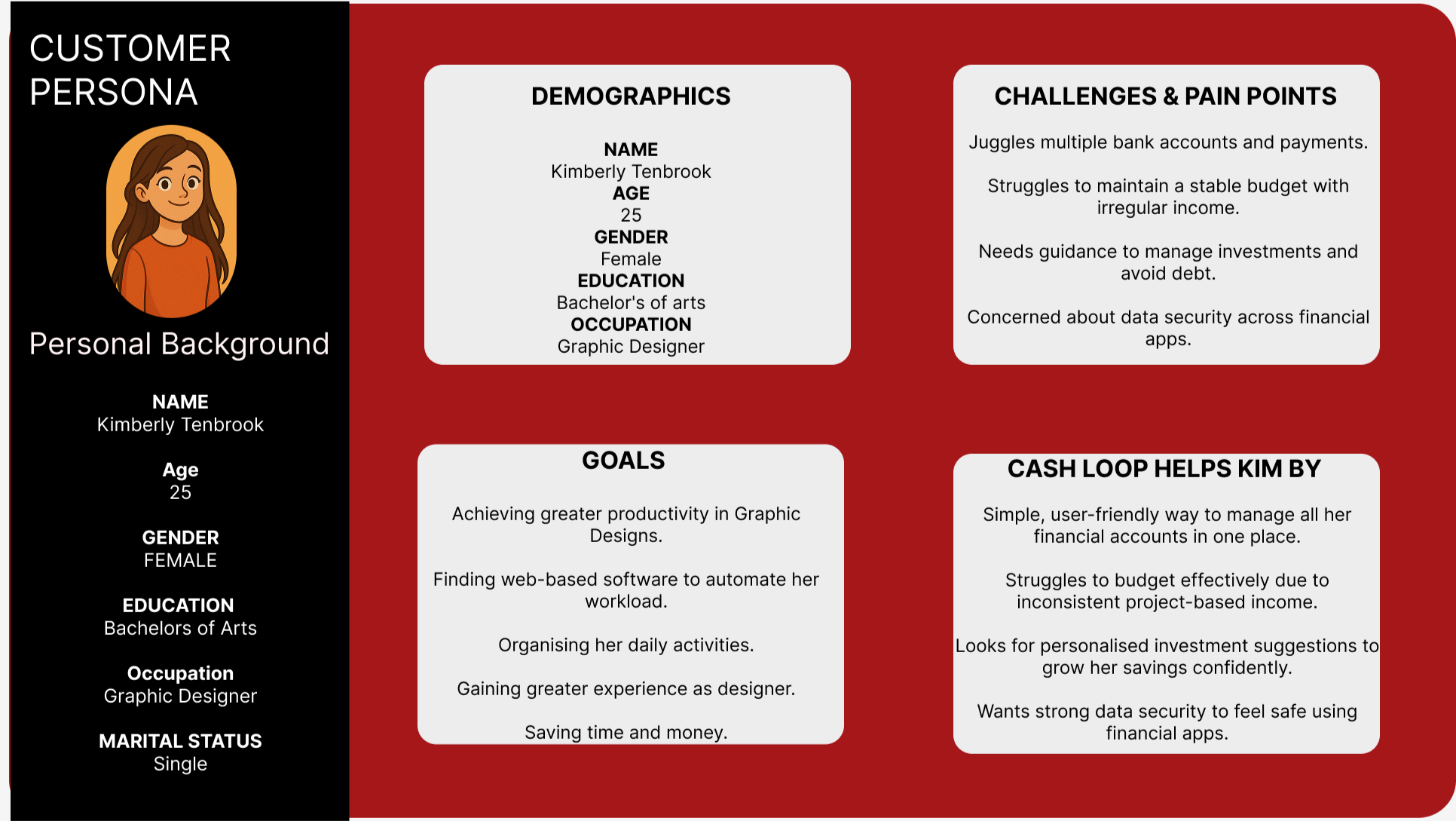

USER RESEARCH

Conducted 10 user interviews and collected 45 survey responses to understand how people manage their finances and what problems they face when using multiple financial apps.

Key Findings

Users switch between several apps between (banking, credit cards & stocks), which creates confusion.

Many struggle to compare spending and investments in one place.

Beginners find investment apps too complicated.

People want a clear, real-time view of their net worth.

Budgeting is difficult, especially for users with irregular income.

User Needs

A single app to manage all financial accounts.

Simple and beginner-friendly investment tools.

Easy access to transactions, balances, and statements.

Clear visuals for spending, saving, and portfolio performance.

Strong data security and privacy.

USER PERSONA

As someone managing multiple financial accounts, I want a single dashboard so I can confidently track all my money without switching apps

SITE MAP

WIRE FRAME

What I Learned by Creating a Unified Finance App

Cash Loop has been a journey of insight, innovation, and deep understanding of how people manage their financial lives. What began as a simple idea—to bring bank accounts, credit cards, and investments into one place—evolved into a mission to simplify financial wellness for everyone. Throughout the process, user needs became our clearest direction. From individuals juggling multiple financial apps to beginners intimidated by investing, their challenges shaped every feature and decision.

Designing CashLoop pushed me to think beyond interfaces and features. It taught me to truly understand users’ emotions—their confusion when switching between apps, their hesitation around investing, and their desire for clear, simple financial insights. Every decision I made, from dashboard layout to budgeting tools, was shaped by these real human needs.

This project strengthened my belief in user-centered design. The more I aligned the product with users’ pain points, the more meaningful the experience became. CashLoop reminded me that great design isn’t just about aesthetics or functionality—it’s about creating clarity, reducing stress, and empowering people to feel more confident in their financial lives.

Ultimately, CashLoop taught me how deeply design can impact someone’s sense of control and peace of mind, and it reinforced why I’m passionate about building thoughtful, human-focused digital products.